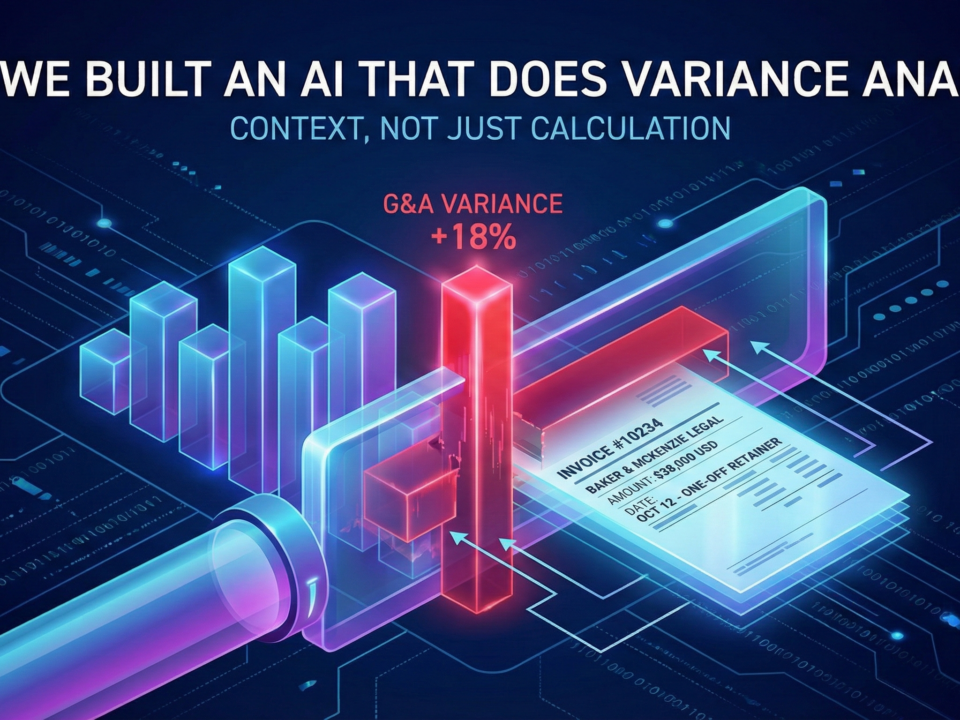

Why We Built an AI That Does Variance Analysis (So Your Team Doesn’t Have To)

January 26, 2026Why Your Best Financial Analysts Are Quitting (Hint: It’s the Copy-Pasting)

The hidden retention crisis in finance teams — and what forward-thinking CFOs are doing about it

Last month, a finance director at a Malaysian property conglomerate shared something that stopped me cold. His best financial analyst — ACCA-qualified, sharp, three years with the company — had just handed in her resignation.

The reason wasn’t salary. It wasn’t a lack of career growth. It wasn’t even a competitor poaching her with a better title.

“She told me she didn’t study accounting for five years to spend 70% of her time copy-pasting numbers between Excel files,” he said. “And honestly? I couldn’t argue with her.”

This isn’t an isolated story. Across Malaysian enterprises — from manufacturing groups to listed conglomerates — finance teams are haemorrhaging talent. And the culprit isn’t what most HR teams think.

The best analysts aren’t leaving for better compensation. They’re leaving because the work doesn’t match what they were hired to do.

You Hired Strategists. You Turned Them Into Data Entry Clerks.

Let’s be honest about what a typical week looks like for a financial analyst at a Malaysian group with multiple subsidiaries:

Monday and Tuesday: Chasing eight different subsidiaries for their Excel submissions. Sending follow-up emails. Waiting. Following up again.

Wednesday: Manually consolidating data from eight different Excel formats — each subsidiary has their own template, their own chart of accounts structure, their own quirks — into one master file.

Thursday: Fixing broken formulas. Reconciling numbers that don’t match. Tracking down why Subsidiary C’s revenue figure is off by RM 47,000 (spoiler: someone accidentally deleted a row).

Friday: Finally running the analysis that was supposed to be the actual job. Except it’s already Friday afternoon, the data is three days stale, and the CFO needed this for a Monday board meeting.

This isn’t an exaggeration. Research from Accenture and FSN consistently shows that finance professionals spend between 47% and 75% of their time on data gathering and validation — not analysis, not strategy, not the work they were trained to do.

The emotional toll is real. I’ve heard variations of the same sentiment from analysts across different companies: “This isn’t what I studied for.”

The Hidden Cost of Losing Your Best People

When a financial analyst resigns, most companies calculate the cost in terms of recruitment fees and training time. But the real cost runs much deeper.

Industry estimates suggest that replacing a skilled finance professional costs between 50% and 200% of their annual salary when you factor in recruitment, onboarding, productivity loss during the transition, and the institutional knowledge that walks out the door.

But here’s what makes this a genuine crisis: the analysts who leave first are almost always the best ones. They’re the ones with options. They’re the ones who know their skills are worth more than data entry work. They’re the ones headhunters are calling.

The ones who stay? Some are genuinely committed to the company. But others may simply be disengaged — showing up, doing the minimum, mentally checked out. The finance community has a term for this now: quiet quitting.

The downstream effects ripple through the entire organisation:

Monthly close cycles stretch longer. Error rates creep up. Reports that used to take three days now take five. The CFO starts asking why the numbers in different reports don’t match. Board members lose confidence in the data. Strategic decisions get delayed because no one trusts the underlying figures.

The problem isn’t the people. It’s the process.

It’s Not a People Problem. It’s a Data Architecture Problem.

To understand why copy-pasting persists in 2026, you need to understand how most Malaysian conglomerates grew.

Each subsidiary was often acquired or established at different times. Each came with its own ERP system — or no ERP at all, just Excel files refined over years by different finance managers with different preferences. Each developed its own chart of accounts, its own reporting templates, its own way of categorising transactions.

Nobody planned for a future where all this data would need to talk to each other. And so it doesn’t.

This is the Excel paradox: the software is flexible enough to do anything, which means everyone does it differently. What starts as a feature becomes a nightmare when you need to consolidate across twelve different “anything” approaches.

I spoke with a group finance manager at a property development company with twelve joint ventures. Each JV submits financials in a different Excel template. Her senior analyst spends three full days every month — three days — just standardising formats before consolidation can even begin. Not analysing. Not adding value. Just making columns match.

Meanwhile, the data she needs for ad-hoc analysis — the kind of insight the CFO actually wants — sits fragmented across shared drives, email attachments, and legacy systems that nobody fully understands anymore.

The result? A highly qualified professional doing work that could theoretically be automated, while the strategic analysis that could differentiate the company never gets done.

What Modern Finance Teams Are Doing Differently

The CFOs who are successfully retaining top finance talent have stopped treating this as a “work harder” problem. They’ve recognised it as an infrastructure problem — and they’re investing accordingly.

The shift is towards centralised data repositories that serve as a single source of truth for group financials. These aren’t just another dashboard layer on top of existing chaos. They’re designed to fundamentally change how data flows through the organisation.

Here’s what that looks like in practice:

Automatic ingestion: Data from multiple sources — ERP exports, Excel uploads, even API connections — flows into one central repository. No more chasing subsidiaries. No more version control nightmares.

Standardisation at entry: The system enforces a common structure. Subsidiaries can still use their preferred formats for input, but the repository standardises and maps everything automatically. Your analyst doesn’t need to know that Subsidiary A calls it “Revenue” while Subsidiary B calls it “Sales Income” — the system handles the translation.

Validation before propagation: AI-powered checks catch anomalies at the point of entry, not three days later when someone notices the P&L doesn’t balance. That RM 47,000 discrepancy? Flagged immediately, before it corrupts downstream reports.

Conversational access: Instead of building pivot tables to answer ad-hoc questions, analysts can simply ask: “What’s our receivables aging for the Penang subsidiary?” or “Show me gross margin trends across all manufacturing entities for the last eight quarters.” The AI handles the query. The analyst interprets the answer.

This isn’t about replacing analysts. It’s about letting them do what they were hired to do. When you remove 30 hours of data wrangling from someone’s month, you’re not just improving efficiency — you’re giving them their professional identity back.

Giving Analysts Their Time Back

This is exactly the problem we set out to solve when building Lestar.

We kept encountering the same pattern: talented finance teams trapped in an endless cycle of data collection and reconciliation, with no time left for the strategic work that actually moves businesses forward. The tools existed to solve this problem — centralised repositories, AI validation, natural language interfaces — but they weren’t being packaged in a way that Malaysian enterprises could actually deploy.

Lestar CEO 360 is our answer to that gap. It’s a centralised repository designed specifically for group finance consolidation, built with the complexities of multi-entity Malaysian businesses in mind.

The system consolidates group financials from multiple subsidiaries — regardless of what ERP they’re running or what Excel format they prefer. AI-powered validation catches errors before they propagate through your reports. And the generative AI chatbot lets your analysts query data conversationally instead of spending hours building pivot tables.

Dashboards update automatically. No more manual refresh. No more “which version is this?” No more Friday afternoons scrambling to reconcile numbers for a Monday board meeting.

We built Lestar because we saw too many finance teams trapped in Excel hell. Our goal is straightforward: let analysts do what they were hired to do — analyse.

Malaysian conglomerates, property developers with multiple JVs, manufacturing groups with regional subsidiaries — these are the organisations seeing the most immediate impact. When your analyst can answer the CFO’s question in five minutes instead of five hours, that’s not just efficiency. That’s a competitive advantage.

Retention Is a Systems Problem

Here’s the thing about financial analysts: they didn’t pursue ACCA or CPA certification to become sophisticated copy-paste operators. They studied for years to understand business, to interpret data, to provide insights that drive decisions.

When you ask them to spend most of their week on work that a well-designed system could handle automatically, you’re not just wasting their skills. You’re actively disrespecting the investment they made in their own development. Eventually, they’ll find somewhere that doesn’t.

The companies that retain top finance talent in 2026 and beyond will be the ones that invest in infrastructure that respects their people’s time and training. Not more dashboards layered on top of broken processes. Not more Excel templates with better formatting. Real architectural change that eliminates the busywork at its source.

If your analysts are spending more time collecting data than interpreting it, the question isn’t whether they’ll leave. It’s when.

Want to see how Lestar can give your finance team their time back? Book a walkthrough — no commitment, just a practical look at how centralised data repositories work in real Malaysian enterprise environments.

Contact us at https://www.mandrill.com.my/contact-us/ or visit lestar.ai to learn more.